421a tax abatement meaning

Established a new 421-a tax exemption program for any project that commenced construction between January 1 2016 and June 15 2019 and was completed on or before June 15 2023 New Program and provided that the New Program would not come into effect until representatives of residential real estate developers and construction labor unions signed a. The 421-a Tax Abatement Program which was resurrected last April after nearly a year of stasis reduces the property taxes on land that is developed for residential use.

421a Tax Abatement Archives Nestapple

The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

. In return developers have to commit a small percentage of the development towards affordable housing. Your property may qualify for a property tax exemption if your property value changed because you did construction on a multi-family residential building. In the 10 years ending in 2020 421-a accounted for 68 of all new apartments in buildings with at least four units according to a report released last month by the NYU Furman Center.

Its a tax break dubbed 421-a and if youre an apartment-dweller here those numbers and letters may not mean much to you. The difference between the J-51 and 421-a abatement is. When you get a tax abatement the government is essentially giving you a tax break on certain types of real estate property business property or even business opportunities.

If the building was rehabilitated or converted from another use the abatement is known as a J-51 tax abatement. The abatement is intended to promote affordable. Its a city-run property tax abatement program for co-ops and condos designed to ease the burden of qualified units taxes.

FYI affordable housing types like Mitchell Lama or HDFC units do not qualify. Some developers have gotten around this by funding and building completely separate properties for the affordable housing. The Section 421a Tax Exemption Program has historically provided extended tax relief for multi-unit residential projects as a way of spurring residential and affordable housing development and has been one of the most utilized tax incentive programs.

If it is newly constructed the abatement is known as a 421-a tax abatement. Every two years during that period the tax break is reduced by 20 percent until its. During the time period thousands of New Yorkers were moving upstate or to the suburbs and City officials feared a decline in residential development.

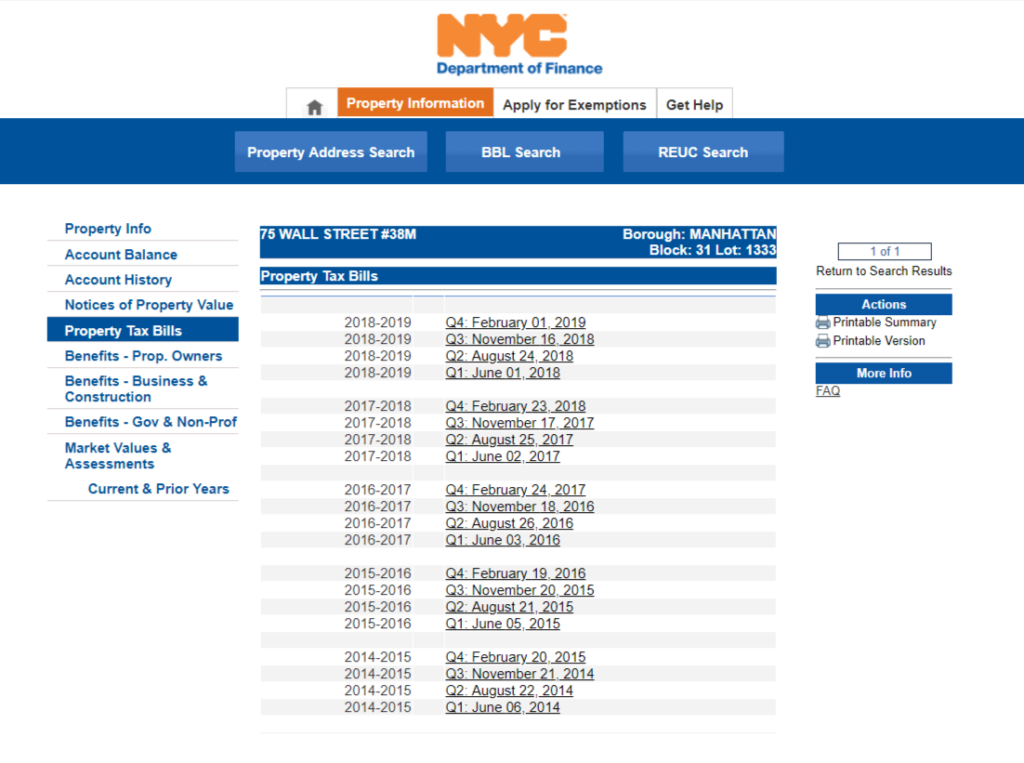

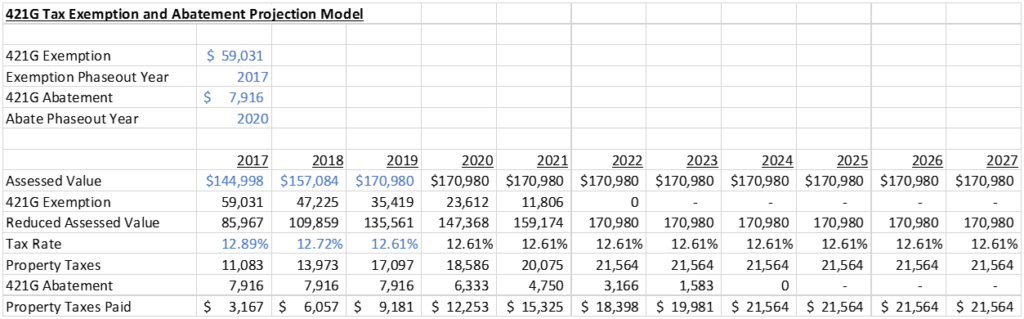

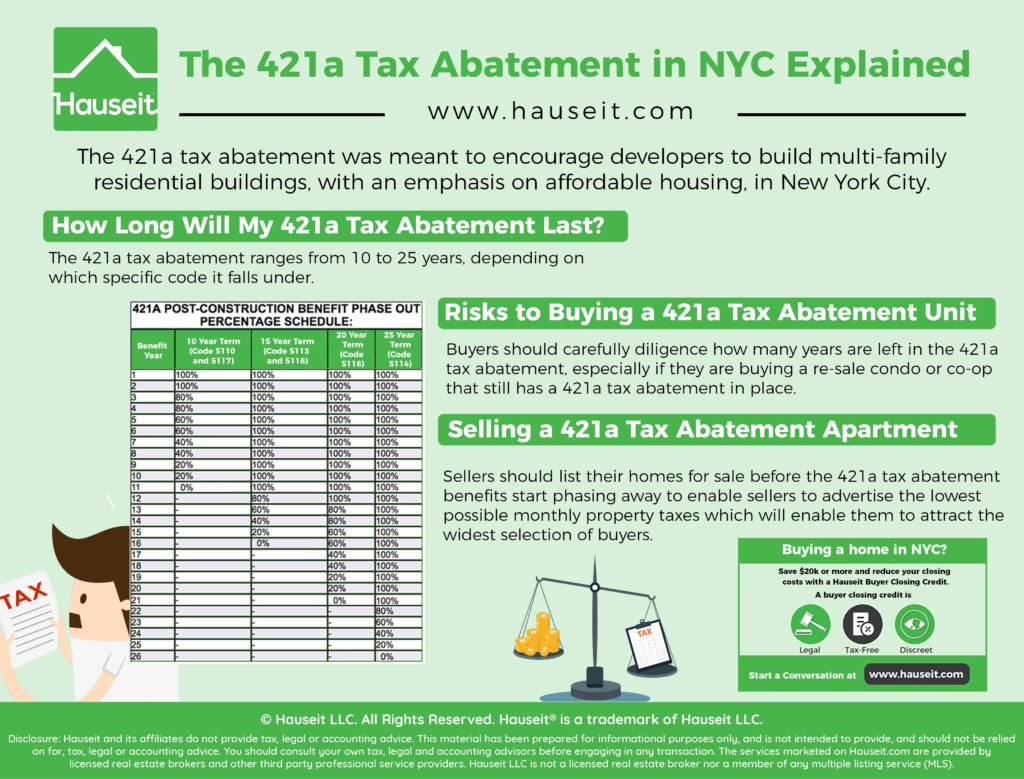

But the tax break set to expire on June 15 is a huge deal for housing in the city. Understanding the 421-a Tax Abatement Program. 10-year term Code 5110 5117 15-year term Code 5113 5118 20-year term Code 5116 25-year term Code 5114 421a tax abatement benefits.

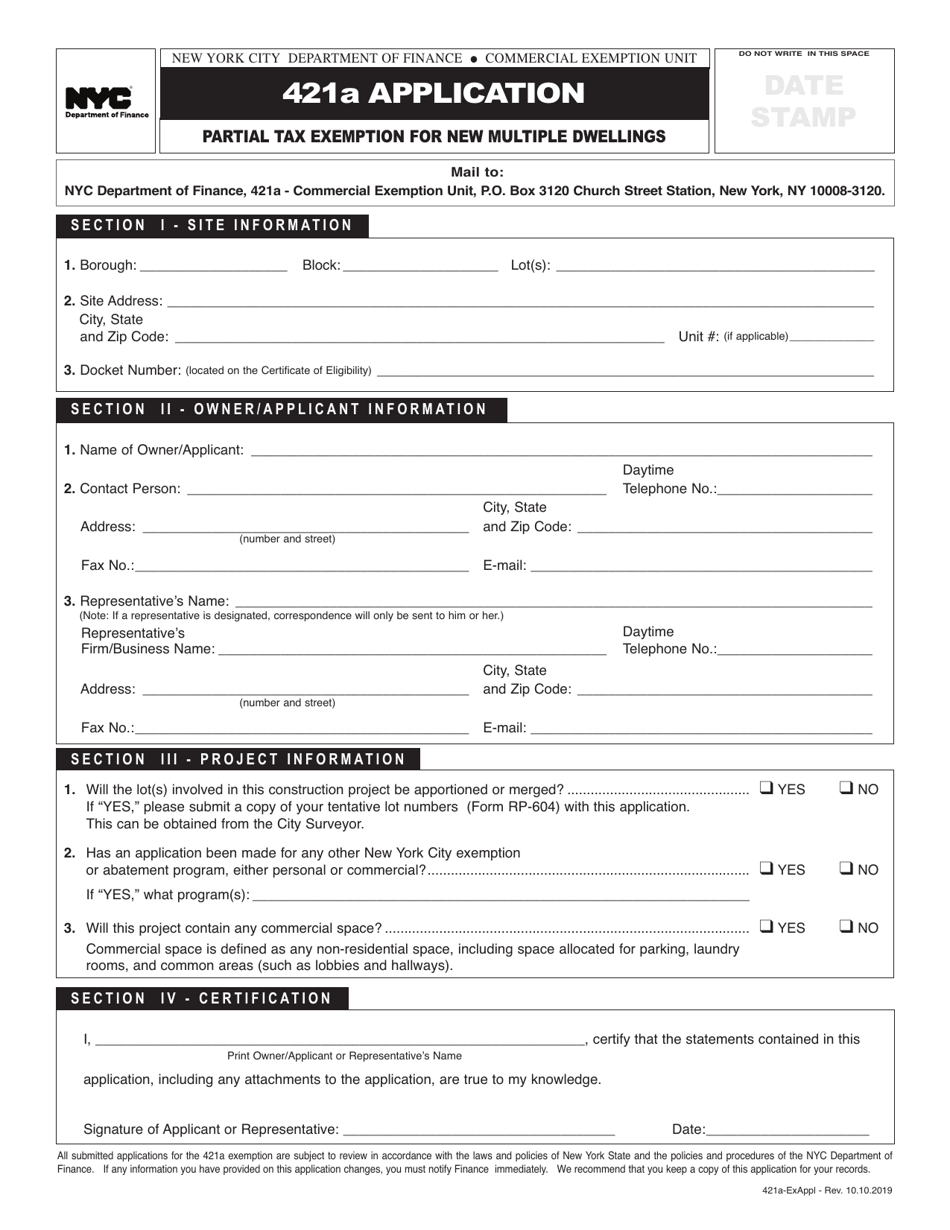

The full 421a tax abatement application package includes DHCR rent registration the restrictive declaration and other documents. It cost 17 billion in lost revenue last year. For several years the owner of a qualifying property pays taxes only on the propertys original value as opposed to the higher value it attains after homes.

First established in 1971 the 421-a tax abatement was designed to lure real estate development back to New York City in a moment of urban decline. The owners of the new property pay significantly lower taxes for the first ten years of the buildings life. Although the policy only applies to New York City and falls on the citys tab it is set at the state level.

In other words when your taxes are abated it means that your taxes are lowered. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. Definition of tax abatement.

Thats followed by a 10-year-long exemption period during which the exemption becomes more of an abatement. The exemption also applies to buildings that add new residential units. If your property appears in the list of 421a exemptions currently being processed for FY19-20 at the following link 421a exemption and you have a question please Contact Us.

HPD accepts a 421a Certificate of Eligibility Application after marketing of affordable units commences and a temporary or permanent certificate of occupancy is issued for the property. For one there are many different types of abatements given to buildings for different reasons. Andrew Cuomo decided to let the Real Estate Board of New York REBNY and.

The 421-a tax abatement was created in 1971 to encourage the development of underutilized or unused land by significantly reducing property taxes on newly developed land for a set period of time. Tax abatement involves real estate properties while tax penalty abatement involves a taxpayer asking the IRS for a reduction or elimination of tax penalties for late tax payments or incorrect amount of taxes paid. The first 421a tax exemption began in the 1970s as a way to incentivize housing development and has been revised over the years to include affordable housing and construction worker wage requirements a battle over which stalled the program for a year in 2016 when then-Gov.

A related program accounted for an additional 21 meaning nine out of every 10 new units benefited from some kind of tax break. The program can be beneficial if you bought a home in the 421a program and the exemption is about to expire. The 421-A Tax Abatement Program was developed to promote the construction of multi-family dwellings by providing tax relief benefits to the owners of the property.

The 421-a tax abatement benefited developers by providing them with tax exemptions for new ground up development. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York. Taxpayers should understand the difference between tax abatement and tax penalty abatement to avoid confusion.

In some buildings the abatements could last up to 35 years. Term lengths of 421a tax abatements and codes. The key 421a tax abatement benefit in NYC is the reduction in property taxes you owe for the term of the program.

What Is The 421g Tax Abatement In Nyc Hauseit

Understanding Rebny S New 421 A Tax Exemption Proposal Association For Neighborhood And Housing Development

What Is The 421g Tax Abatement In Nyc Hauseit

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

Nyc Tax Abatements Guide 421a J 51 And More Makingnyc Home

Tax Abatement Nyc Guide 421a J 51 And More

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Tax Abatement Nyc Guide 421a J 51 And More

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

What Is A 421a Tax Abatement In Nyc Streeteasy

What Is The 421g Tax Abatement In Nyc Hauseit

Is 421 A Dead Where To Find Nyc S Remaining Tax Abatement Deals 6sqft

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

New York City 421a Partial Tax Exemption For New Multiple Dwellings Application Download Printable Pdf Templateroller

What Is The 421g Tax Abatement In Nyc Hauseit

The 421a Tax Abatement In Nyc Explained Hauseit

The 421a Tax Abatement In Nyc Explained Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo